Delta Award Winning Story

Woolworths Financial Services

How Woolworths Financial Services leverages their dedicated consumer community to test new products and deliver exceptional experiences

+

How Woolworths Financial Services leverages their dedicated consumer community to test new products and deliver exceptional experiences

+

Success Metrics

3% increase in CSAT score related to improved collections experience

Increased speed to insight and actionable decision making

New product and loyalty program supported from insights

In collaboration with IQbusiness Insights, Woolworths Financial Services has launched a bespoke community called Woolworths Financial Services DifferenceMakers, which provides dedicated customers a space to share feedback to help shape strategic decision making and product development.

To ensure customer-led journey design, this community contributes to the development of loyalty programs, brand strategy, and new products. In just 6 months, new community-driven insights have improved the product development process and increased speed to insights while reducing external research costs.

In collaboration with IQbusiness Insights, Woolworths Financial Services has launched a bespoke community called Woolworths Financial Services DifferenceMakers, which provides dedicated customers a space to share feedback to help shape strategic decision making and product development.

To ensure customer-led journey design, this community contributes to the development of loyalty programs, brand strategy, and new products. In just 6 months, new community-driven insights have improved the product development process and increased speed to insights while reducing external research costs.

In consultation with strategic partner IQbusiness Insights, Woolworths Financial Services launched their own dedicated insight community called Woolworths Financial Services DifferenceMakers, which informs the development of new products, loyalty programs, brand values, and concept testing to ensure development and strategy are customer-led.

“We were excited to introduce and develop this program together with the Woolworths Financial Services team so they can get even closer and speak directly to consumers. They have done great work in a short amount of time to drive impact for their business”, explains Jake Orpen, Executive Director: Commercial at IQBI.

Insights from the community are combined with other research tactics including the overarching VoC program that tracks customer experience feedback daily and traditional research for larger strategic projects. The DifferenceMakers community is leveraged to support concept and tactical testing and further dig into the “why”, giving a window into the lives of Woolworths Financial Services customers on their financial decision making, shopping behaviors, wellness needs, and experiences with other financial brands.

Insights from the community are used across the business from sales to collections and helps inform the product development during agile production schedules.

In less than 6 months, the CX team has supported the build and launch of new products and services through community research and testing. They have seen increases in the speed to deliver insights and in how feedback is actioned due to timely feedback and less reliance on outsourced research work. The resulting cost savings has been significant especially considering the real-time impact on strategic new product development and loyalty programs. Feedback trackers evaluating the collections experience have also helped to better understand customer needs and pressures leading to more care and empathy in collections communication driving CSAT scores up 3% to date.

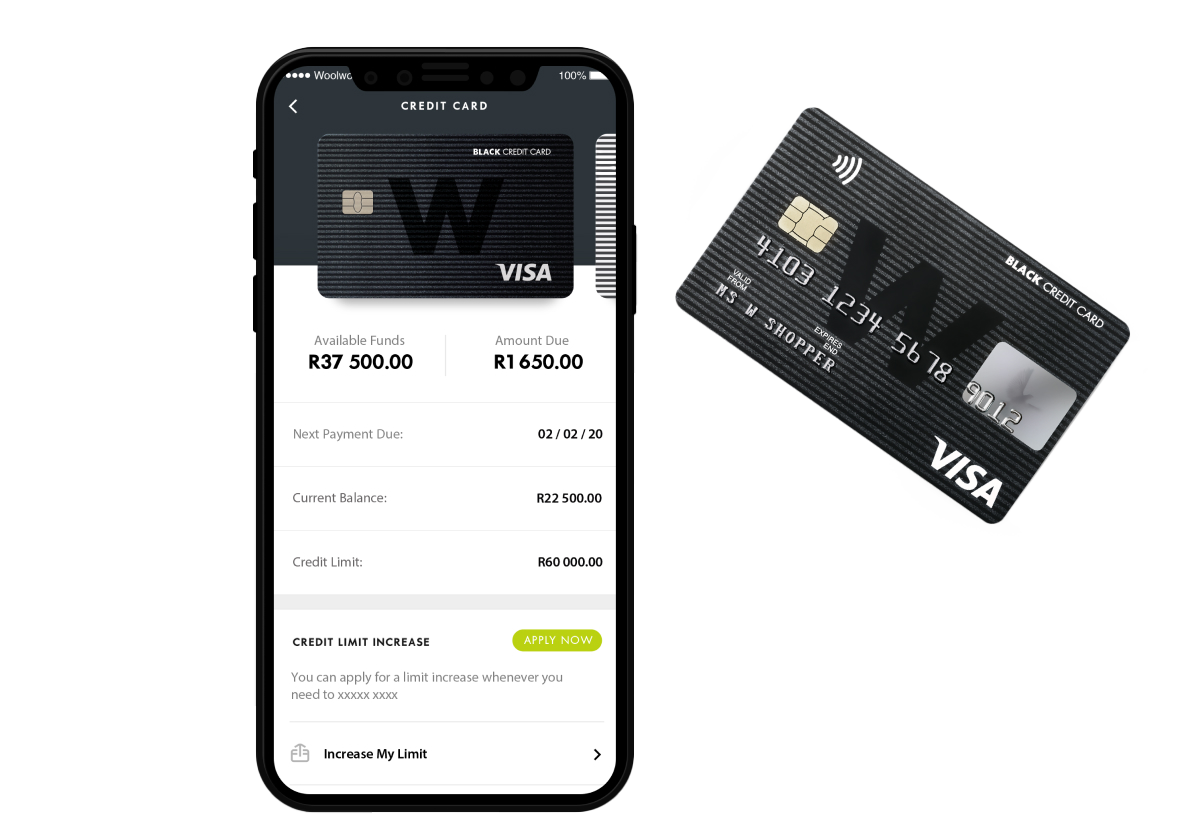

By leveraging the Woolworths Financial Services DifferenceMakers community throughout the agile product development process, they are now able to get feedback during early stages of content testing and validation. Customer insights have supported the launch of new products such as WPet Insure and the development of other new product opportunities. The team is also using insights to shape future channels, particularly WhatsApp, and supported the Digital Payments team in building functionality that meets customer needs and market diversity.

Lastly, with this new capability the team at IQbusiness Insights has supported the Woolworths Financial Services Customer Experience team in sharing best practices, gaining a new set of research skills, and guiding them to new opportunities for growth and learning in their respective roles.

“We're incredibly proud of the capability we have delivered, with the support of IQbusiness Insights. It has changed the way we develop and execute strategic projects and obtain insights from customers to inform business decision making, faster and far more cost effectively. We look forward to developing and growing our community further.”

– Brenda Peacock, Head of Customer Experience, Woolworths Financial Services

to Rapidly Changing Customer Needs in the Age of Coronavirus

How Virgin Money UK successfully embraced the digital disruption in the banking industry

How Bendigo Bank supports customer-led decision making in real-time

How Prudential Singapore accelerates product growth with customer insights

How AXA Philippines innovates in line with customer needs

Client communities guide Sun Life’s Client Impact Strategy

How Insular Life tracks the customer journey to transform the customer experience

AIA leverages a dedicated community of customers to curate compelling propositions

How Woolworths Financial Services leverages their dedicated consumer community to test ...

How BPI expanded and evolved their insights program to align with customer-obsessed brand ...

.jpg)

How BMO leveraged timely customer feedback through a banking transition

CIBC provides personalized financial solutions to clients across North America. The ...

How in-depth UX and market research leads to increased customer retention and strategy ...